Branches of Accounting

It monitors and reports disbursements and receipts from the accounts, ensuring proper fund allocations. The branch follows cash basis accounting, which means it involves recording cash at the time of receipt. Generally, estates, trusts, and receiverships utilize this type of accounting. For example, the reports and records can be analyzed by a financial accountant to check the previous quarter’s performance and make the required changes in the next quarter. This is helpful in analyzing the balance sheet and preparing the P&L Account.

Financial Accounting

This focuses on the use and interpretation of financial information to make sound business decisions. It’s similar to financial accounting, but this time, it’s reserved for internal use, and financial statements are made more frequently to evaluate and interpret financial performance. The most important function of cost accounting is to determine costs, control costs and provide costing information to management so that they are able to make informed decisions. The management uses cost accounting information to optimise the utilisation of scarce resources and control the expenditure incurred under various heads. In addition to calculating income and other taxes, tax accounting helps businesses legally reduce their tax burden.

What Are the Branches of Accounting?

Managerial accounting seeks to streamline operations, increase revenue, and give management financial information that has an impact on budgeting and planning. Forecasting is done in this area of accounting to advise management on the best ways to achieve objectives and maintain profits. Performing internal audits using cost to volume profit (CVP) or break-even point (BEP) analysis, as well as other factors that influence decision-making, are all part of managerial accounting. Accounting departments adhere to specific accounting standards established by groups like the Financial Accounting Standards Board (FASB) in the US. The general accepted accounting principles (GAAP) are a set of ideas, customs, presumptions, and guidelines that accountants adhere to. GAAP helps to clear up any ambiguity and promotes consistency and uniformity in accounting practices.

Optimize business spends with OfEx

Tax accounting also analyzes tax-related business decisions and any other issues related to taxes. These accounting branches have been developed as a result of rapid economic development and technological improvements, that increased the company’s scale of operations. Due to this very reason, the management functions has become complicated and resulted in the development of branches.

Marginal Costing for Decision-Making

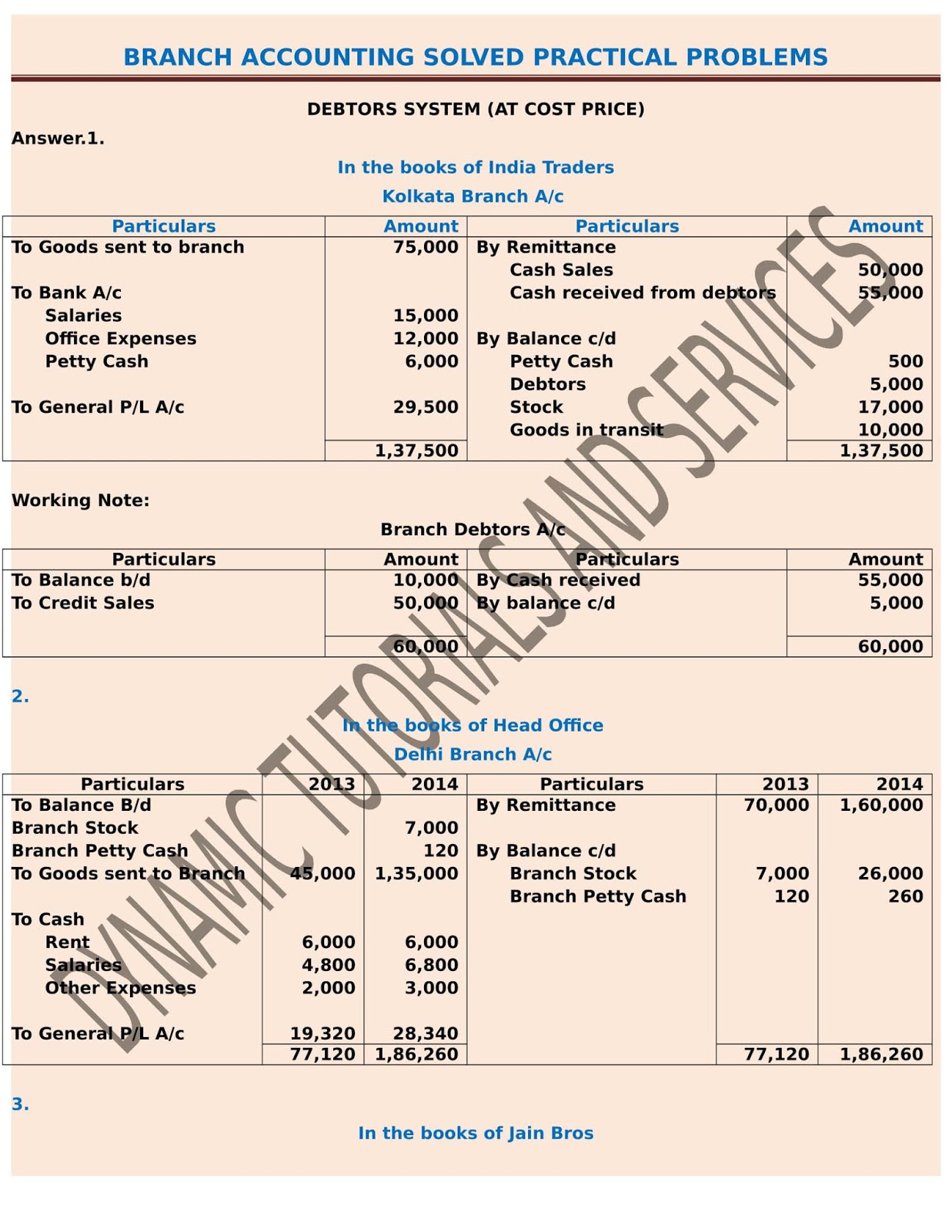

By understanding these twelve branches of accounting, businesses can better manage their finances and stay ahead of competitors in today’s ever-changing economic landscape. The essential objectives of branch accounting includes determining a company’s branches revenue & expenditure, and assets & liabilities. It is useful when the business organization operates several branches at different locations because it helps to understand and track the performance of each department.

Cost Accounting

Financial accounting focuses on external reporting for stakeholders, while managerial accounting provides internal information for decision-making. Under this branch of accounting, state and federal tax rules are included which is used during tax planning or preparing the tax returns. Tax accounting focuses on the effects of tax policies on a business and tries to minimize the taxes or the consequences of tax decisions through advisory services. These accountants are responsible to calculate the income and other taxes that are dependent on the business structure. As we know, taxes and income brackets are different for different companies. Tax accounting had proper tax laws whether the company is a sole proprietorship, corporation, or limited liability cooperation (LLC).

The pace of economic development can be primarily attributed to technological advancements. With an increase in the complexity of operations, the scope of management has also been widened. Construction, installation, application, and observation are part of this process. Companies divide accounting duties according to how a business conducts internal audits, the procedures and policies in place, and who is authorised to perform what accounting task. Financial accounting is also termed as “general purpose accounting” because the information generated by it is published for the use of everyone connected with the business enterprise. Integrating automation and artificial intelligence (AI) into accounting has brought transformative changes.

- Managers of ABC analyze the cost incurred to operate the stores, which allows them to determine the most economically viable shop.

- To determine future financial actions, cost accounting regularly analyzes actual costs that exceed the budget.

- The pace of economic development can be primarily attributed to technological advancements.

It provides essential information that a firm’s management needs to execute its functions. It seeks to make managerial control more effective by encouraging efficient planning. 3 important tax dates you need to know for 2016 Management accounting, also known as managerial accounting, is based on the conceptualization of accounting as a tool by which managerial effectiveness is enhanced.

The management accounting system uses historical as well as estimated data to generate useful reports and information to be used by internal management for decision-making purposes. As the reports generated by the management accounting system are not accessed and used by any external party, the business enterprises don’t need to take care of GAAPs while drafting them. Government accounting focuses on public-sector entities’ unique financial management and reporting requirements. It involves the application of accounting principles to track and manage public funds.